- Home

- Blog

Blog

If you’re overwhelmed by your debt, the one thing you may wish for more than anything else is a blank slate. You can use a personal loan to refinance your existing debt. That means you’ll have one monthly payment at one interest rate instead of the stress caused by a bunch of smaller bills coming due on different days of the month. Of course, this isn’t a solution for everyone.

If you’re mortgage shopping, you may be overwhelmed by the number of options. Dozens of lenders, each with their own rates, terms, conditions and costs, can make the decision feel that way. But it doesn’t have to be that difficult! The choice of which mortgage to go with starts with a simple question: fixed-rate or adjustable?

Due to the COVID-19 pandemic, many organizations adjusted their practices and provided relief to people in need throughout their communities. Listerhill assisted these organizations by featuring them and donating $500 to their efforts! This article features Meals on Wheels through the Community Action Agency of Northwest Alabama.

Due to the COVID-19 pandemic, many organizations adjusted their practices and provided relief to people in need throughout their communities. Listerhill assisted these organizations by featuring them and donating $500 to their efforts! This article features The Rescue Me Project.

Due to the COVID-19 pandemic, many organizations adjusted their practices and provided relief to people in need throughout their communities. Listerhill assisted these organizations by featuring them and donating $500 to their efforts! This article features Big Brothers Big Sisters of the Shoals.

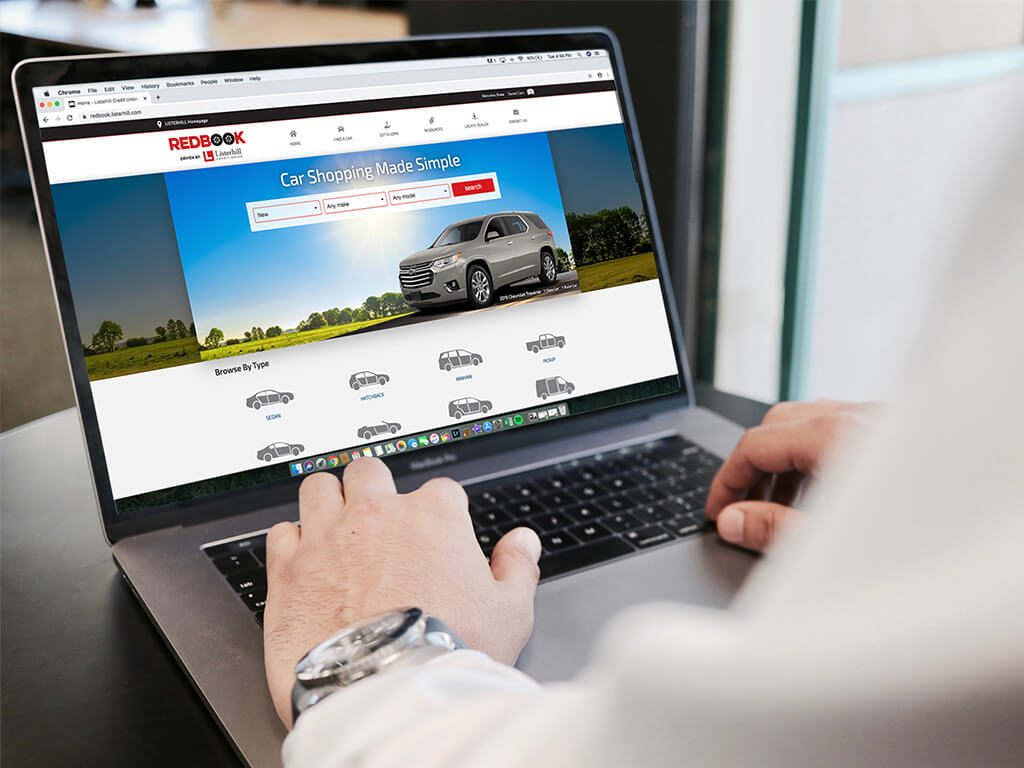

You've heard of Kelley Blue Book and Black Book. They tell you the value of a car, but they don't help you find the car. We're proud to announce Listerhill RedBook - an online showroom of more than 4 million vehicles to help you find your next car!

If you’re considering opening a credit card, it’s essential to understand how they work. Interest rates, fees, and billing cycles are just a few of the many factors that can affect your financial health.