- Home

- Understanding FICO® Scores

Understanding FICO® Scores

What are FICO® Scores?

FICO® Scores are numbers that summarize your credit risk. Scores are based on a snapshot of your credit file at particular consumer reporting agency at a particular point in time, and help lenders evaluate your credit risk. FICO® Scores influence the credit that’s available to you and the terms, such as interest rate, that lenders offer you.

How are FICO® Scores calculated?

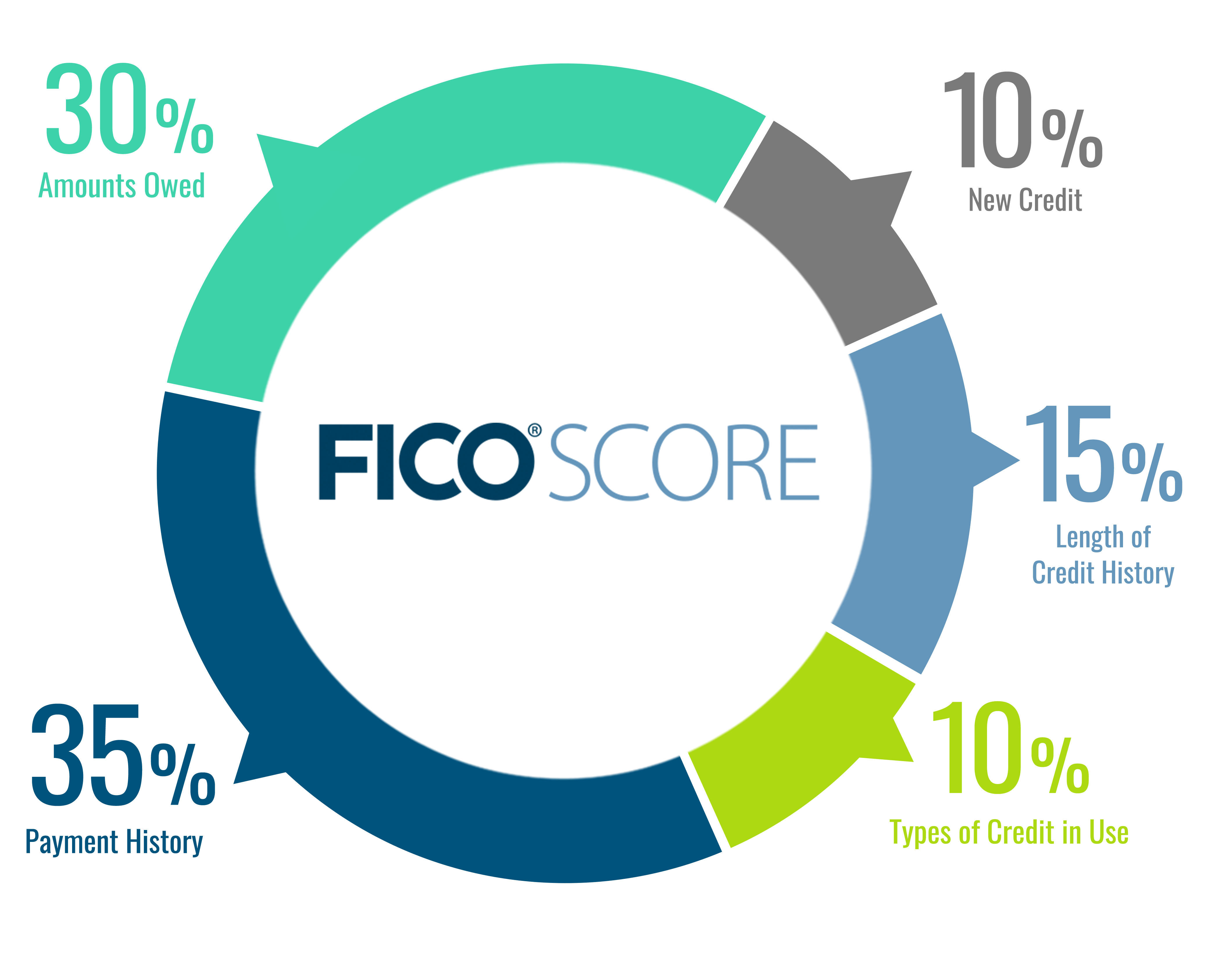

FICO® Scores are calculated from many different pieces of credit data in your credit report. This data is grouped into five categories as outlined below. The percentages in the chart reflect how important each of the categories is in determining how FICO® Scores are calculated.

How often will I receive my FICO® Score?

Program participants will receive their FICO® Score 9 based on Equifax data updated on a quarterly basis, when available. You may review your FICO® Score on your account statement through Listerhill's Online Banking or by viewing your paper statement.

Will receiving my FICO® Score impact my credit?

No. The FICO® Score we provide to you will not impact your credit.

Where does the information used to calculate my FICO® Score come from?

FICO® Scores are based on the credit information in a credit file with a particular consumer reporting agency (CRA) at the time the score is calculated. The information in your credit files is supplied by lenders, collection agencies and court records. Not all lenders report to all three major CRAs. The FICO® Score that we provide to you is based on data from your Equifax report as of the ‘pulled on date’ shown with your score.

What are Key Score Factors?

When a lender receives a FICO® Score, "key score factors" are also delivered, which explain the top factors from the information in the credit report that affected the score. The order in which FICO® Score factors are listed is important. The first indicates the area that most affected that particular FICO® Score and the second is the next significant area. Knowing these score factors can help you better understand your financial health over time. However, if you already have a high FICO® Score (usually in the mid-700s or higher), score factors are informative but, not as significant since they represent very marginal areas where your score was affected.

Why is my FICO® Score different than other scores I’ve seen?

There are many different credit scores available to consumers and lenders. FICO® Scores are the credit scores used by most lenders, and different lenders may use different versions of FICO® Scores. In addition, FICO® Scores are based on credit file data from a particular consumer reporting agency, so differences in your credit files may create differences in your FICO® Scores. The FICO® Score 9 based on Equifax data that is being made available to you through this program is the specific score that we use to manage your account. When reviewing a score, take note of the score date, consumer reporting agency credit file source, score type, and range for that particular score.

Why do FICO® Scores fluctuate/change?

There are many reasons why a score may change. FICO® Scores are calculated each time they are requested, taking into consideration the information that is in your credit file from a particular consumer reporting agency (CRA) at that time. So, as the information in your credit file at that CRA changes, FICO® Scores can also change. Review your key score factors, which explain what factors from your credit report most affected a score. Comparing key score factors from the two different time periods can help identify causes for a change in a FICO® Score. Keep in mind that certain events such as late payments or bankruptcy can lower FICO® Scores quickly.

How do I check my credit report?

Because your FICO® Score is based on the information in your credit report, it is important to make sure that the credit report information is accurate. You may get a free copy of your credit report weekly. To request a copy of your credit report, please visit: http://www.annualcreditreport.com. Please note that your free credit report will not include your FICO® Score.

Why are you providing FICO® Scores?

Reviewing your FICO® Scores can help you learn how lenders view your credit risk and allow you to better understand your financial health.

Disclaimer: FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Listerhill Credit Union and Fair Isaac are not credit repair organizations as defined under federal or state law, including the Credit Repair Organizations Act. Listerhill Credit Union and Fair Isaac do not provide "credit repair" services or advice or assistance regarding "rebuilding" or "improving" your credit record, credit history or credit rating.