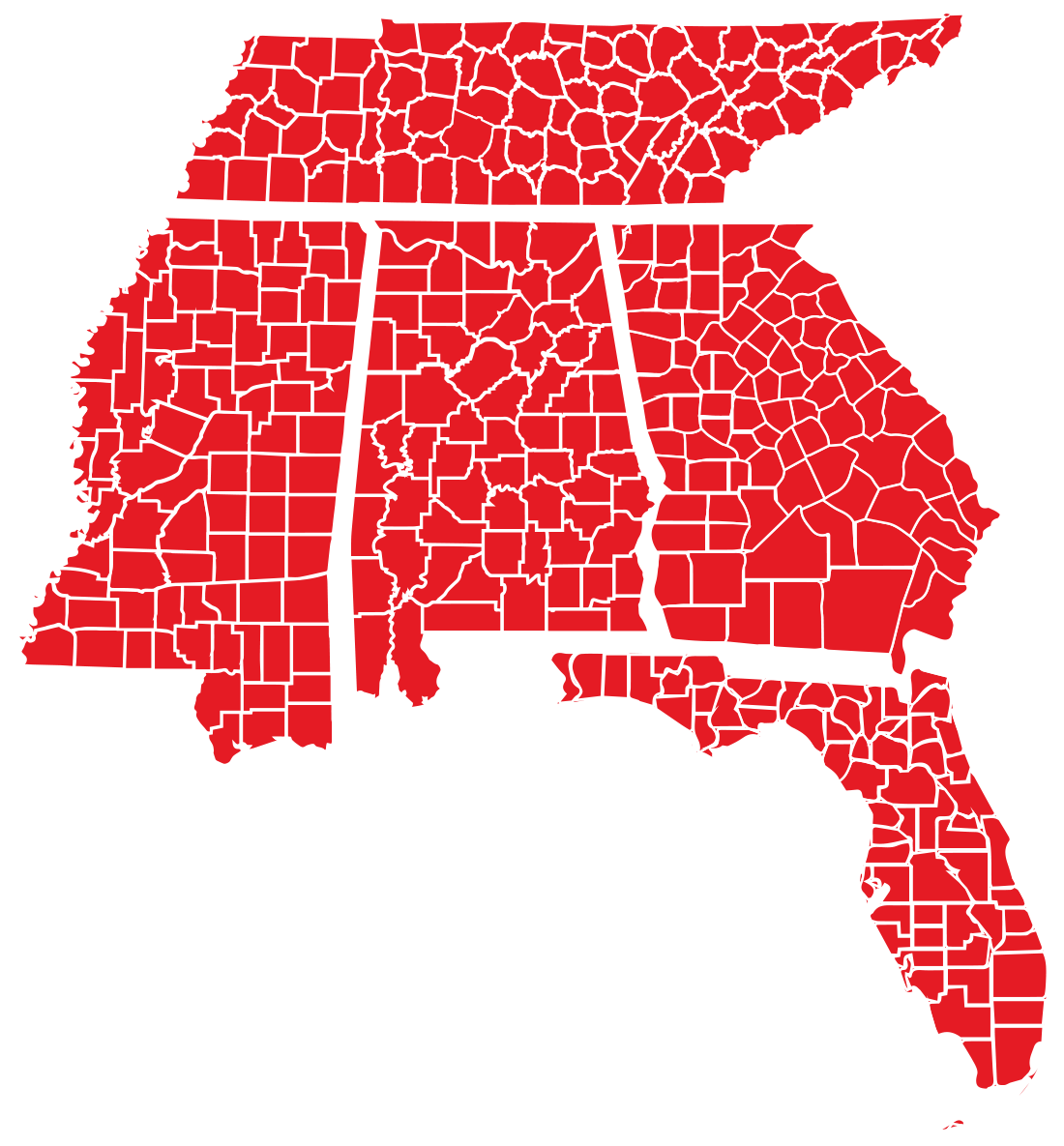

Listerhill will be able to bring more loans to your customers by now serving the entire states of Alabama, Florida, Georgia, Mississippi, and Tennessee!

|  |

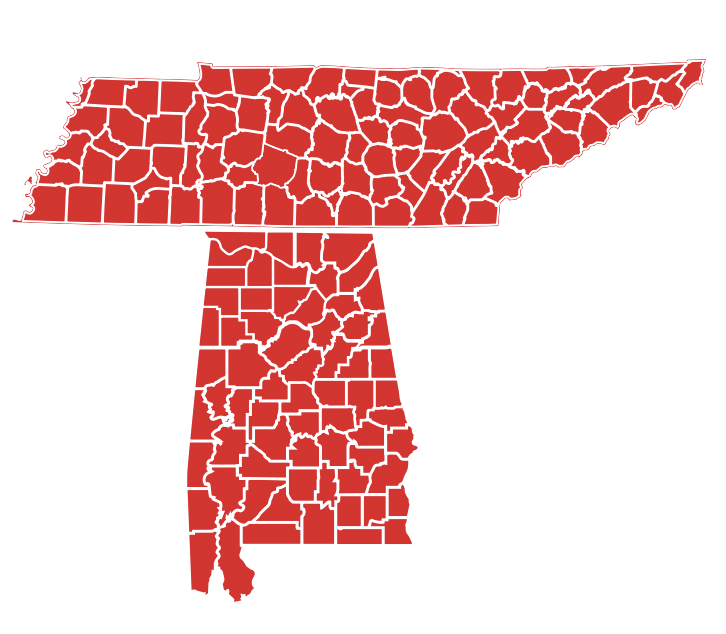

| Before November 10th, Listerhill served those who live, work, attend school, or own property in the states of Alabama and Tennessee. | Effective April 4th, in addition to our current markets, Listerhill will be able to serve anyone who lives, works, attends school, or owns property throughout the states of Alabama, Florida, Georgia, Mississippi, and Tennessee. |

Potential members can join by agreeing to join an association that is affiliated with Listerhill.

How?

During the process of applying for a loan, applicants can agree to join an association and be eligible for membership through Listerhill. There is no cost to the member.

What does this mean for you?

More loans! However, this should represent no major change to what you do every day. Using our updated Request For Services (RFS) form below, please make sure to complete the "Eligibility" section (at top of page 1 under "Member No.") using this information:

- For applicants in Listerhill's twelve counties in northwest Alabama or in Maury County, Tennessee, please use current county codes on file.

- For all other applicants throughout Alabama, please use code 8000 for the Alabama Consumer Council. For more information on the Alabama Consumer Council, click here.

- For all other applicants throughout Tennessee, please use code 8001 for the Athens State Alumni Association. For more information on the Athens State Alumni Association, click here.

- For all other applicants throughout Georgia, please use code 8001 for the Athens State Alumni Association. For more information on the Athens State Alumni Association, click here.

- For all other applicants throughout Mississippi, please use code 8001 for the Athens State Alumni Association. For more information on the Athens State Alumni Association, click here.

- For all other applicants throughout Florida, please use code 8001 for the Athens State Alumni Association. For more information on the Athens State Alumni Association, click here.